2025 Section 179 Bonus Depreciation

Blog2025 Section 179 Bonus Depreciation. In 2025, it rises to $1,220,000. A massive new tax law called the tax cuts and jobs act (tcja), went into effect in 2018.

100% bonus depreciation for heavy vehicles. 179 expensing, a manufacturer can elect to expense 100% of the cost of qualified property up to a specified maximum.

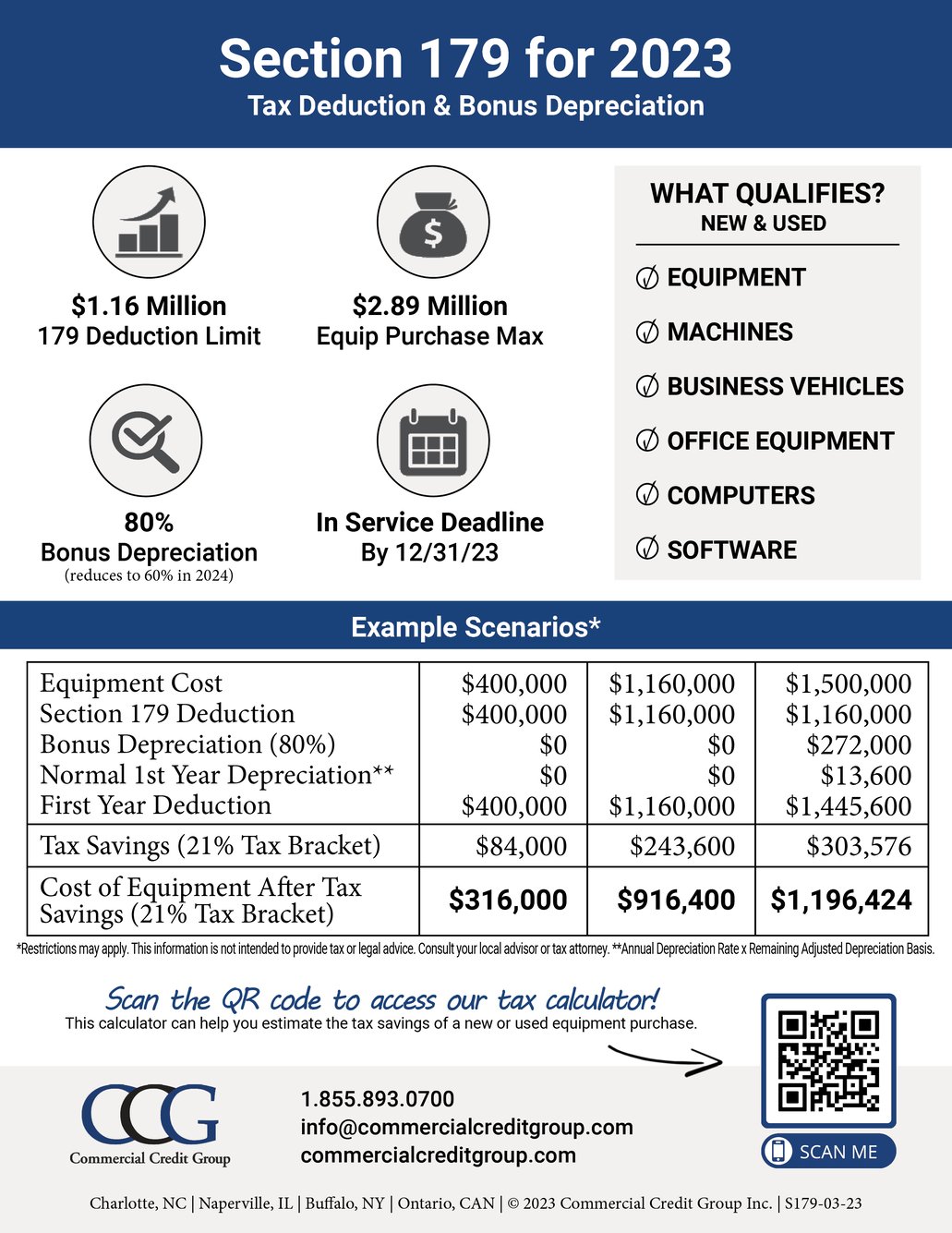

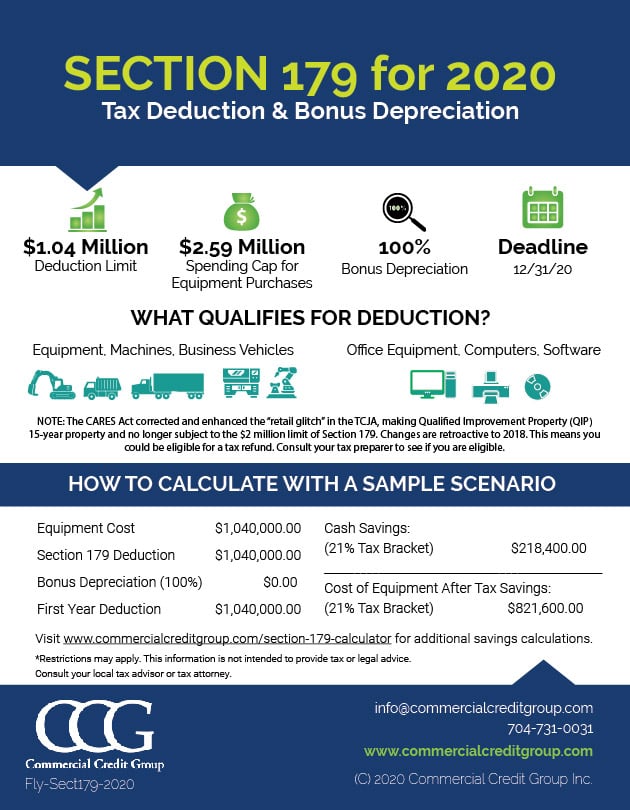

The limit for the section 179 deduction for 2025 is $1.22 million, with a phaseout on the amount that can be deducted beginning at $3.05 million of total eligible.

Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions, In 2025, it rises to $1,220,000. It begins to be phased out if 2025 qualified asset additions exceed.

Section 179 and Bonus Depreciation at a glance United Leasing & Finance, 100% bonus depreciation for heavy vehicles. The limit for the section 179 deduction for 2025 is $1.22 million, with a phaseout on the amount that can be deducted beginning at $3.05 million of total eligible.

Bonus Depreciation Definition, Examples, Characteristics, This is a 20% deduction on their taxable business income. 20% this schedule shows the percentage of bonus depreciation that businesses can.

Calculate depreciation deduction MuzakiraAntek, It begins to be phased out if 2025 qualified asset additions exceed. 100% bonus depreciation for heavy vehicles.

Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions, 20% this schedule shows the percentage of bonus depreciation that businesses can. A massive new tax law called the tax cuts and jobs act (tcja), went into effect in 2018.

Section 179 Depreciation and Bonus Depreciation USA, Claiming section 179 depreciation expense on the company’s federal tax return reduces the true cost of the purchase to $130,000 (assuming a 35% tax bracket), freeing up $70,000 in cash savings. What is changing in 2025?

Section 179 vs. Bonus Depreciation United Leasing & Finance, For example, if your company purchases $2,890,001 in equipment, then your total section 179 deduction limit is $1,159,999. Under the tax cuts and jobs act (tcja), 100% bonus depreciation is available for property placed in service through 2025.

Difference Between Bonus Depreciation and Section 179, Special bonus depreciation and enhanced expensing for 2025. A massive new tax law called the tax cuts and jobs act (tcja), went into effect in 2018.

Bonus Depreciation vs. Section 179 What's the Difference? JX, A massive new tax law called the tax cuts and jobs act (tcja), went into effect in 2018. Howdy, this is david groce, your texas tax and law man.

How Section 179 & Bonus Depreciation Work YouTube, The percentage of bonus depreciation phases down in 2025 to 80%, 2025 to 60%, 2025 to 40%, and 2026 to 20%. In 2025, the bonus depreciation rate will drop to 60%, falling by 20% per year thereafter until it is completely phased out in 2027 (assuming congress doesn't take.

The percentage of bonus depreciation phases down in 2025 to 80%, 2025 to 60%, 2025 to 40%, and 2026 to 20%.