Ira Contribution For 2025

BlogIra Contribution For 2025. Get information about ira contributions and claiming a deduction on your individual federal income tax return for the amount you contributed to your ira. Ira contribution limit increased for 2025.

Even if your income exceeds contribution limits for a roth ira, there’s still a way to fund one.

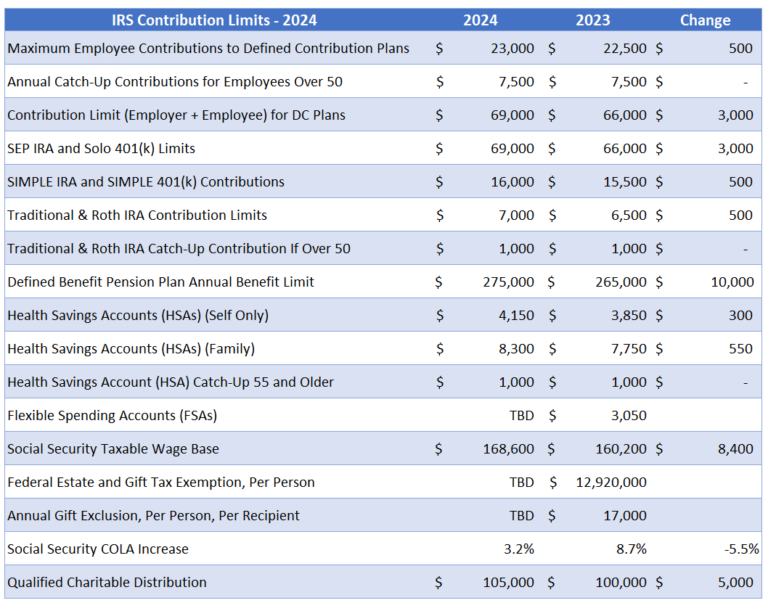

IRS Unveils Increased 2025 IRA Contribution Limits, The irs has released the new limits for 2025 and, thanks to the relatively high rate of inflation, you’ll be able to put more money in your ira accounts next year. You can contribute a maximum of $7,000 (up from $6,500 for 2025).

IRA Contribution Limits And Limits For 2025 And 2025, The 2025 contribution limits are up by $500, so it will be a bit easier to grow your savings. The irs limits how much you can.

IRA Contribution Limits in 2025 Meld Financial, For 2025, the maximum contribution rises to $7,000 and $8,000, respectively. 2025 ira contribution limits | charles schwab.

IRA Contribution Limits 2025 Finance Strategists, And for 2025, the roth ira contribution. Even if your income exceeds contribution limits for a roth ira, there's still a way to fund one.

The IRS just announced the 2025 401(k) and IRA contribution limits, $6,500 per taxpayer 49 and younger. The irs limits how much you can.

IRA Contribution Limits for 2025, 2025, and Prior Years, 401 (k) contribution limits are increasing from $22,500 to $23,000 in. The new retirement contribution and gift exemption.

401k 2025 Contribution Limit Chart, The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older. The limit increased to $7,000 for 2025, with an extra $1,000 for investors age.

Unlock Your Financial Future A Quick Guide to 2025's IRA and, Best roth ira for mobile trading. In 2025, the annual contribution limit for both roth and traditional iras rises to $7,000 for those under 50, and $8,000 for those 50 and above.

2025 IRS 401k IRA Contribution Limits Darrow Wealth Management, This is an increase from 2025, when the limits were $6,500 and $7,500, respectively. Ira contribution limits for 2025.

Roth IRA Contributions Limit 2025 All you need to know about the Roth, The 2025 contribution limits are up by $500, so it will be a bit easier to grow your savings. 2025 ira contribution limits | charles schwab.